Forsyth County Nc Property Tax Exemption . it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. property tax homestead exclusion for elderly or disabled persons: North carolina excludes from property taxes a portion of. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do so. creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year,.

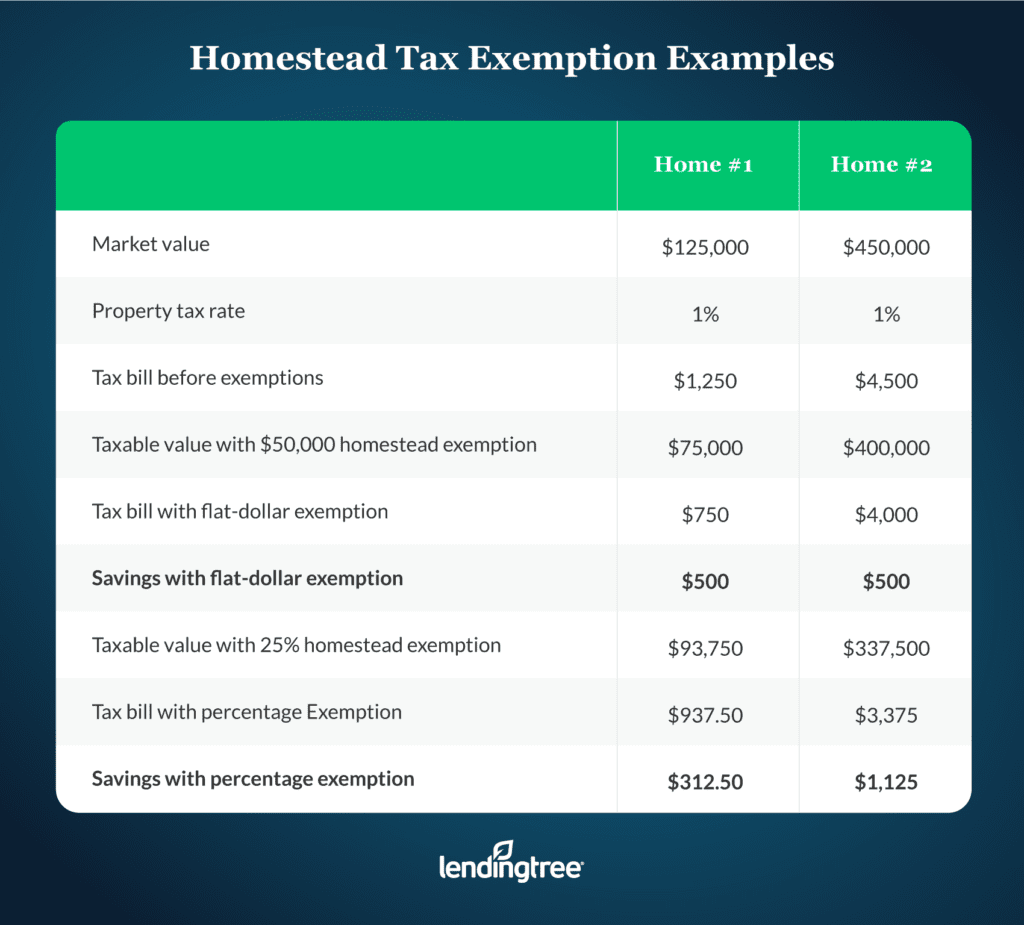

from www.lendingtree.com

forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do so. property tax homestead exclusion for elderly or disabled persons: it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year,. creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. North carolina excludes from property taxes a portion of. bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or.

What Is a Homestead Exemption and How Does It Work? LendingTree

Forsyth County Nc Property Tax Exemption creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. property tax homestead exclusion for elderly or disabled persons: forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do so. it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year,. North carolina excludes from property taxes a portion of.

From exosbfhjh.blob.core.windows.net

Forsyth County Property Tax Payment at Carolyn Pollock blog Forsyth County Nc Property Tax Exemption the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year,. except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school. Forsyth County Nc Property Tax Exemption.

From www.ncjustice.org

N.C. Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Forsyth County Nc Property Tax Exemption creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. North carolina excludes from property taxes a portion of. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do so. property tax homestead exclusion for elderly or disabled. Forsyth County Nc Property Tax Exemption.

From www.ezhomesearch.com

The Ultimate Guide to North Carolina Property Taxes Forsyth County Nc Property Tax Exemption creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. property tax homestead exclusion for elderly or disabled persons: except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. bill search provides users the opportunity to view real. Forsyth County Nc Property Tax Exemption.

From www.formsbank.com

Long Form Property Tax Exemption For Seniors printable pdf download Forsyth County Nc Property Tax Exemption creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year,. except. Forsyth County Nc Property Tax Exemption.

From www.northcarolinahealthnews.org

Assessedvalues_hospitalproperty North Carolina Health News Forsyth County Nc Property Tax Exemption creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. property tax homestead exclusion for elderly or disabled persons: North carolina excludes from property taxes a portion of. it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. the owner cannot have. Forsyth County Nc Property Tax Exemption.

From www.youtube.com

Which Property Tax Exemption ? YouTube Forsyth County Nc Property Tax Exemption bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do so. property tax homestead exclusion for elderly or disabled persons: it is a complete. Forsyth County Nc Property Tax Exemption.

From www.templateroller.com

Form AV65 Download Fillable PDF or Fill Online Builder Property Tax Exemption North Carolina Forsyth County Nc Property Tax Exemption creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption,. Forsyth County Nc Property Tax Exemption.

From www.templateroller.com

Form AV10 Download Fillable PDF or Fill Online Application for Property Tax Exemption or Forsyth County Nc Property Tax Exemption it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do. Forsyth County Nc Property Tax Exemption.

From www.yumpu.com

North Carolina Property Tax Exemptions and Williams Mullen Forsyth County Nc Property Tax Exemption bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. North carolina excludes from property taxes a portion of. it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. property tax homestead exclusion for elderly or disabled persons: except. Forsyth County Nc Property Tax Exemption.

From fcso.us

Tax Administration Forsyth County Nc Property Tax Exemption bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for. Forsyth County Nc Property Tax Exemption.

From taxrelief.org

Seniors and Veterans Get Your Property Tax Cut Iowans for Tax Relief Forsyth County Nc Property Tax Exemption property tax homestead exclusion for elderly or disabled persons: bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. North carolina excludes from property taxes a portion of. the. Forsyth County Nc Property Tax Exemption.

From www.tiffanypropertyinvest.com

North Carolina Property Tax Exemptions What Are They? Forsyth County Nc Property Tax Exemption North carolina excludes from property taxes a portion of. bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. creation of deferred taxes that will become. Forsyth County Nc Property Tax Exemption.

From www.exemptform.com

How To Get A Sales Tax Certificate Of Exemption In North Carolina Forsyth County Nc Property Tax Exemption creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption,. Forsyth County Nc Property Tax Exemption.

From www.townofantigonish.ca

Low Property Tax Exemption Town News Forsyth County Nc Property Tax Exemption the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year,. it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. property tax homestead exclusion for elderly or disabled persons: forsyth county residents seeking to apply for the homestead exemption,. Forsyth County Nc Property Tax Exemption.

From www.countyforms.com

Forsyth County Property Tax Form Forsyth County Nc Property Tax Exemption North carolina excludes from property taxes a portion of. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do so. creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. except as provided below, an owner claiming an. Forsyth County Nc Property Tax Exemption.

From www.cutmytaxes.com

Forsyth County Property Tax Assessment Cutmytaxes Forsyth County Nc Property Tax Exemption property tax homestead exclusion for elderly or disabled persons: forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now do so. creation of deferred taxes that will become immediately due and payable, with interest, when the property loses eligibility. bill search provides users the opportunity to. Forsyth County Nc Property Tax Exemption.

From www.pdffiller.com

Part One Chapter 4 Property Tax Exemptions Doc Template pdfFiller Forsyth County Nc Property Tax Exemption it is a complete listing of property owners, their street addresses, legal addresses, property locations, exemptions,. the owner cannot have an income amount for the previous year that exceeds the income eligibility limit for the current year,. forsyth county residents seeking to apply for the homestead exemption, or the age 65 plus school tax exemption, can now. Forsyth County Nc Property Tax Exemption.

From www.wfmynews2.com

Is your property tax bill correct? NC man says he found mistakes Forsyth County Nc Property Tax Exemption except as provided below, an owner claiming an exemption or exclusion from property taxes must file an application for the. bill search provides users the opportunity to view real estate, individual, and personal property tax bills that have been paid, or. creation of deferred taxes that will become immediately due and payable, with interest, when the property. Forsyth County Nc Property Tax Exemption.